EQ Bank Card Review

As I mentioned in a previous post, I have been on the hunt for a new no foreign transaction fee card. I have a few annual expenses that are paid in USD and most credit cards charge an additional 2.5% foreign transaction fee. I have a Rogers Platinum Mastercard that charges a 2.5% fee but pays back 3% for an effective 0.5% cash back, but redemption is a hassle. That’s why I’m looking for a no foreign transaction fee card that doesn’t require me to jump through additional hoops.

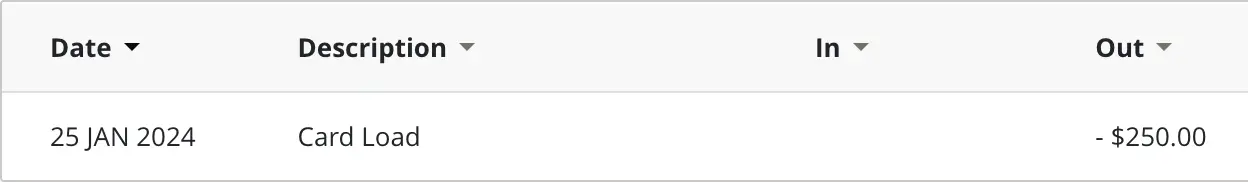

The EQ Bank Card is a Prepaid Mastercard. You get a separate account specifically for the EQ Bank Card. From your Daily Savings Account, you can transfer money into your EQ Bank Card account where it’s ready to spend. There are a few things that I like about this setup. The first is that you cannot overdraw from your account. If you’re paying more than your EQ Bank Card account holds, the transaction will fail. Simply load more money onto your EQ Bank Card for instant access. I can see this as a huge selling point for those who are strict about budgeting. Second, it’s a separate account. If someone gains access to your EQ Bank Card, they can’t access your Daily Savings Account. They can only access what’s loaded onto your EQ Bank Card up, to $5,000 per day. I don’t expect to keep much money in this account, and EQ Bank limits the account to a $10,000 maximum balance.

What other benefits do you get? The card pays a cash back of 0.5%. Tat’s equivalent to the Rogers Platinum Mastercard without the redemption hassle. Any idle money sitting around in the EQ Bank Card account earns the same interest rate as your Daily Savings Account. There’s no need to move money between accounts to maximize interest payout. Currently, EQ Bank offers a 2.5% interest rate with an additional 1.5% (total of 4%) if you direct deposit your paycheque. You can also withdraw cash from any Canadian ATM without fees. If an ATM charges fees, EQ Bank will reimburse you. I don’t see myself using this benefit.

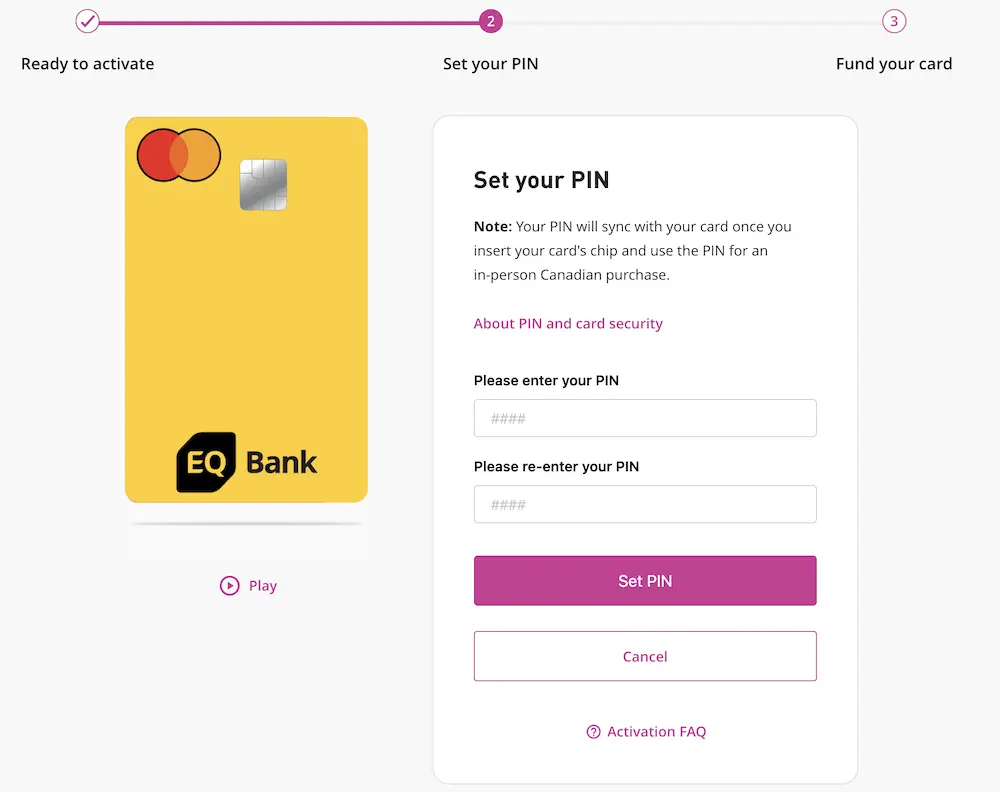

I recently signed up for and received my EQ Bank Card in the mail. When you sign up for an EQ Bank Card, the EQ Bank Card account remains pending until you receive and activate the card. Once your card arrives, click on “My card has arrived”. EQ Bank will send you a verification code and then ask for the last 4 digits of the EQ Bank Card along with the expiry month and year. Finally, it will ask you to set a PIN and then you’re all set. You can start transferring money to your new EQ Bank Card.

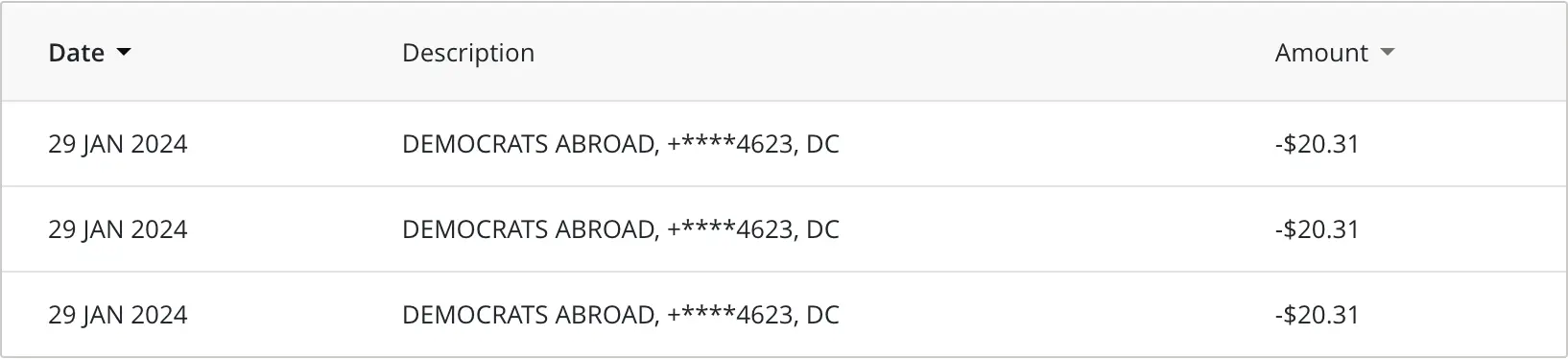

So far it has lived up to its promises regarding no foreign transaction fee. I received the standard interest rate on my balance, but I haven’t received the cash back yet as it’s too early. I really like this card and can see myself using it for personal USD expenses that won’t benefit from insurance, price protection, etc. that credit cards offer. I’ve already changed my payment information on all recurring USD subscriptions.

Soon I can finally say goodbye to the Rogers Platinum Mastercard.