EQ Bank Notice Savings Account Review

There are many online banks out there offering high-interest savings accounts (HISAs). The usual suspects, such as Tangerine Bank and Simplii Bank, have a lottery where some customers receive short-term promotional interest rates. I’ve been riding the 5+% interest rate lottery at Tangerine Bank for a while now. Companies like Wealthsimple offer a sliding scale depending on which status customers reach. With a Wealthsimple Cash account, all clients receive a base 4% interest rate. Premium clients with $100k in assets receive a 4.5% interest rate and Generation clients with $500k in assets receive a 5% interest rate. Non-Generation clients who direct deposit at least $2,000 per month can earn a 0.5% boost, since interest rates top out at 5%. Traditional brick-and-mortar banks have been offering paltry interest rates. For example, our TD account offers no interest on balances, so we keep a minimum amount of money there.

On the other hand, EQ Bank has been offering a consistent 2.5% interest rate on their personal savings accounts. After Wealthsimple offered their 0.5% interest rate boost for direct deposits, EQ Bank offered a 1.5% interest rate boost on direct deposits. At 4% interest, EQ Bank was starting to become competitive, but it was still not enough to keep clients away from Wealthsimple. I have to give it to Wealthsimple, though. Their products and promotional offers have been aggressive and it’s clear that they want to attract as many clients away from both traditional brick-and-mortar banks as well as online banks.

EQ Bank’s response to the high interest rates is their recently launched Notice Savings Account.

What is a Notice Saving Account?

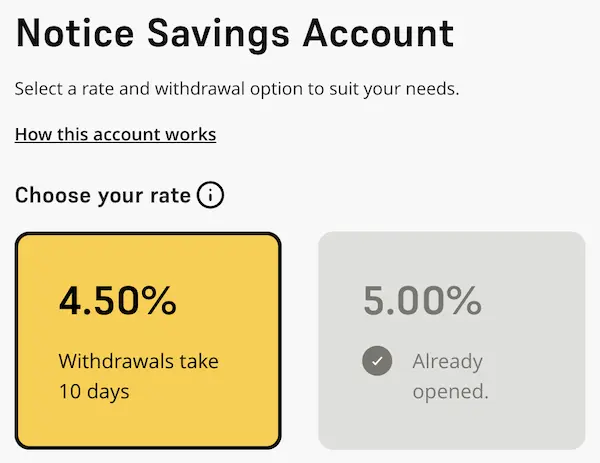

A Notice Savings Account is similar to a personal savings account. The difference is that you have to give EQ Bank advanced notice when you plan to withdraw from the account. Notice Savings Accounts come in 2 flavors, a 10-day and a 30-day account offering 4.5% and 5% interest rates, respectively. 30 days may seem like a long time to give notice of withdrawal, so customers can open one of each Notice Savings Account. From what I read, customers can still withdraw immediately by calling customer service, but they forego the accrued interest. In my opinion, this is similar to a cashable GIC.

Opening a Notice Savings Account

A Notice Savings Account was a no-brainer for me. I keep some money in my EQ Bank personal savings account, which earns 2.5% interest. I rarely, if ever, move that money to another bank. I opened a 30-day Notice Savings Account on the day that the product was launched. Unfortunately, there were technical difficulties, but I was able to successfully open an account later that day.

Opening a Notice Savings Account is very easy and only takes a couple of minutes. You simply go to the Notice Savings Account product page and click the “Open Notice Savings Account” button. On the next screen, you can select whether you want a 10-day or 30-day account, enter the standard information regarding the use of the account, and confirm that you are opening the account for personal use. As I mentioned earlier, customers may open an account for each duration.

Withdrawing from a Notice Savings Account

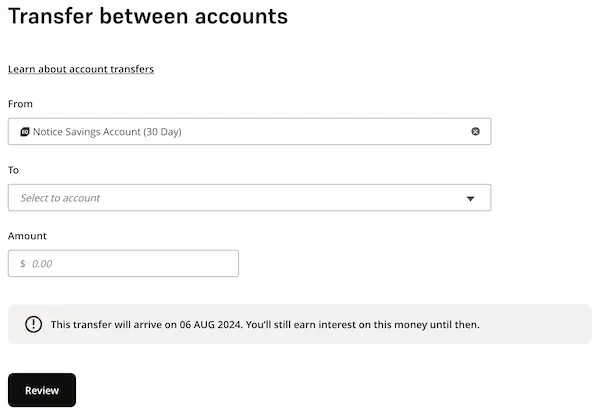

In the one month that I held this account, I have yet to withdraw from it. However, I went through the motions of withdrawing from the account for the benefit of this post. Customers can transfer money from the Notice Savings Account to any of their EQ Bank accounts or any linked account. However, the day that the transfer will arrive is preset. It would be nice if the transfer page allowed customers to select a date in the future. For example, I may know that I need to withdraw money 45 days in advance. I either have to initiate the transfer now and lose out on a few days of interest or I have to remember to initiate the transfer later. It doesn’t seem that difficult to do since most banks allow customers to schedule a bill payment in the future.

Downsides to a Notice Savings Account

The only downside to the Notice Savings Account is that you have to notify EQ Bank in advance that you plan to withdraw. While that may seem inconvenient for customers, I expect most customers will use this type of account for their emergency funds. If customers need to dip into their emergency funds, I expect that they can use their credit cards. They should be able to give EQ Bank enough advanced notice of withdrawal in time to pay off their monthly credit card bill. If a 30-day notice is too long, customers can always open a 10-day account or both.

Conclusion

EQ Bank’s Notice Savings Account is a unique product offering that puts this small online bank back on the map. They’re finally competitive again. But Wealthsimple’s Cash account remains enticing as they don’t require advanced notice to earn high interest. The only hurdle is the amount of assets that customers need to earn higher interest rates. EQ Bank offers high interest rates to every customer regardless of the amount of assets they hold. Therefore, I think EQ Bank offers a compelling product for the everyday customer.