Identity Verification for US Government Websites

I don’t recall if I mentioned it here on this website, but on my previous website, I mentioned that I’m an American expat living in Canada. Over 330 million people live in the United States (circa 2021) with an additional 8 million Americans living the expat life. Not surprisingly, the countries with the most US expats are Mexico and Canada, in that order. But along with living outside your country of citizenship comes additional headaches such as taxes, accessing government services, etc.

I’m a member of Democrats Abroad and they recently hosted a webinar with id.me. The US government partnered with id.me to perform identity verification for its websites. While you can log into your Social Security website using login.gov credentials, you can only log into the IRS website using id.me. Earlier this year, I wanted to log into the IRS website to track the progress of my refund, so I started the identity verification process. But because it was nighttime when I started the application, I didn’t want to start a video call late at night. Eventually, I gave up.

The webinar was very useful as representatives from id.me provided tips to successfully navigate the identity verification process. Here are the tips that I thought were noteworthy:

- Start the application process from the partner website. For instance, if you want to log into the IRS website, start the application process from the IRS website. This helps streamline the questions and verification process.

- Like Highlander, there can only be one (account). If you already have an id.me account and either don’t remember your email address or have a new email address, don’t create another account. If you’re having problems logging in, try the forgot your password link and if all else fails, contact id.me support.

- If you don’t know if you already have an account, you can contact id.me support.

- While creating a new account, do not go through the streamlined process. The streamlined process assumes your permanent address is in the US. Instead, choose options like “I do not live in the United States” or “I do not have the listed documents”. That will take you down a route with human verification via video call.

- You can use foreign identification documents. If the text is in a different language, you can provide a translation on a separate piece of paper and take a photo of the identification document along with the translation. The translation does not need to be certified or notarized. Do not mark up the original identification document with the translation.

- You may only provide non-expired identification documents.

- When taking photos of your documents, take the best quality photos that you can. Besides ensuring that the document is legible, don’t cover the corners or sides.

- You do not need to complete the application process or the verification call on your smartphone. You can do this from your web browser.

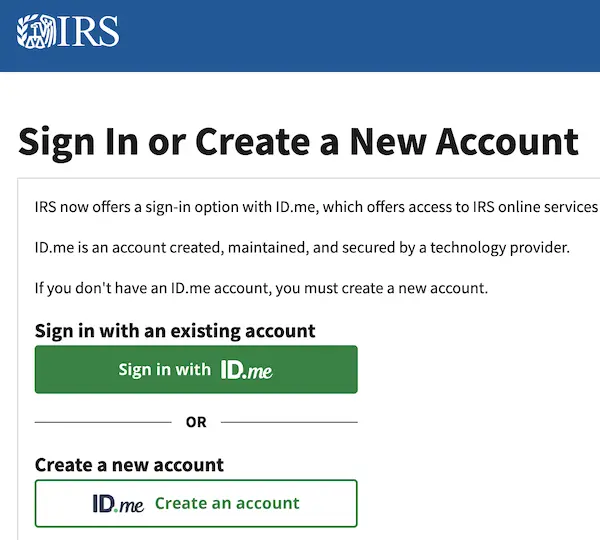

After the webinar, I felt empowered to complete the identity verification process. After all, I wanted access to my IRS account and the only way in was through id.me. From the IRS website, I clicked “Sign in with id.me”. On the sign in page, I selected to sign in with Google instead of creating new credentials. This is a personal choice for me because I don’t want the burden of remembering or storing yet another password. If I could log in with my Google account for every website, I would.

id.me allowed me to continue the account creation process. Previously, I uploaded a photo of my US passport. It wasn’t the best picture but id.me didn’t allow me to upload a new one. Next, I selected “I do not have the listed documents”. The choice of documents on the next page was anything with my full social security number on it. I don’t have my social security card since I didn’t think I would ever need it. Of the remaining options, the only viable option for me was a non-SSA 1099 tax form. I looked through my tax documents and realized that my US accounts only show the last 4 digits of my social security number. Finally, I remembered that Questrade provides a 1099 tax form because I declared myself as a US citizen and Questrade follows FATCA rules. The 1099 tax form provided by Questrade has my full social security number. The last identity document that I provided was my Canadian driver’s license, front and back.

After I provided photos of those documents, I simply had to wait for a video call. It took about 10 minutes in a queue waiting for document verification followed by at least 5 minutes waiting for id.me to join the video call. While waiting in the queue, id.me tells you what identity documents you must physically show. For me, it was my US passport and my Canadian driver’s license. Once id.me joined the video call, they verified that I wasn’t sent into the video call through an unknown source, that I clicked through from the IRS website, and that no one was telling me what to say. Next, they verified my name and email address. Finally, they wanted to verify the information on my physical identity documents. During the webinar, id.me showed a demonstration video of the video call and the actor simply showed their driver’s license next to their face. It seemed unrealistic because no one can read text that small. During my video call, id.me asked me to bring the document closer such that it was taking up most of the video real estate. Once they verify those documents, that’s it – your identity is verified.

To be honest, the entire identity verification process was pretty easy. The only difficulty I had was finding a document showing my full social security number.

I was very pleased with the webinar hosted by Democrats Abroad. I ended up donating to receive links to 3 other recorded webinars that I missed in the past about investment and retirement as an expat.