Recent Purchase: Emera Inc

September is historically the worst month for the stock market [1], but also usually when I remember that I should buy securities again. I recently put together a buy list and have been waiting for technical indicators to tell me that selling pressure is starting to subside. Added to my buy list is Emera Inc (EMA.TO). It is an electric utility company that operates in Atlantic Canada and Florida. I recently purchased shares at $50.00. I have existing shares of Emera at a higher price, so this purchase reduced my average cost basis.

Utility companies are highly regulated. Emera boasts that 96% of its income comes from regulated utilities. While the downside of regulation is that utilities can only expect modest growth as utility rate increases are regulated, the upside is that they are good at predicting their future earnings. To make up for the modest growth, utility companies must pay out a decent dividend. In order to obtain a higher return, investors should be cautious to buy shares of utility companies when they are trading at or below fair value. So why did I purchase shares of Emera?

- The stock price looked undervalued when using EBITDA as a valuation metric. To be fair, I should have used earnings as a valuation metric.

- There is insider buying at higher prices.

- 4 out of 6 analysts say that Telus is a buy. The lowest price target is approximately $54.

- The dividend yield is 5.5%.

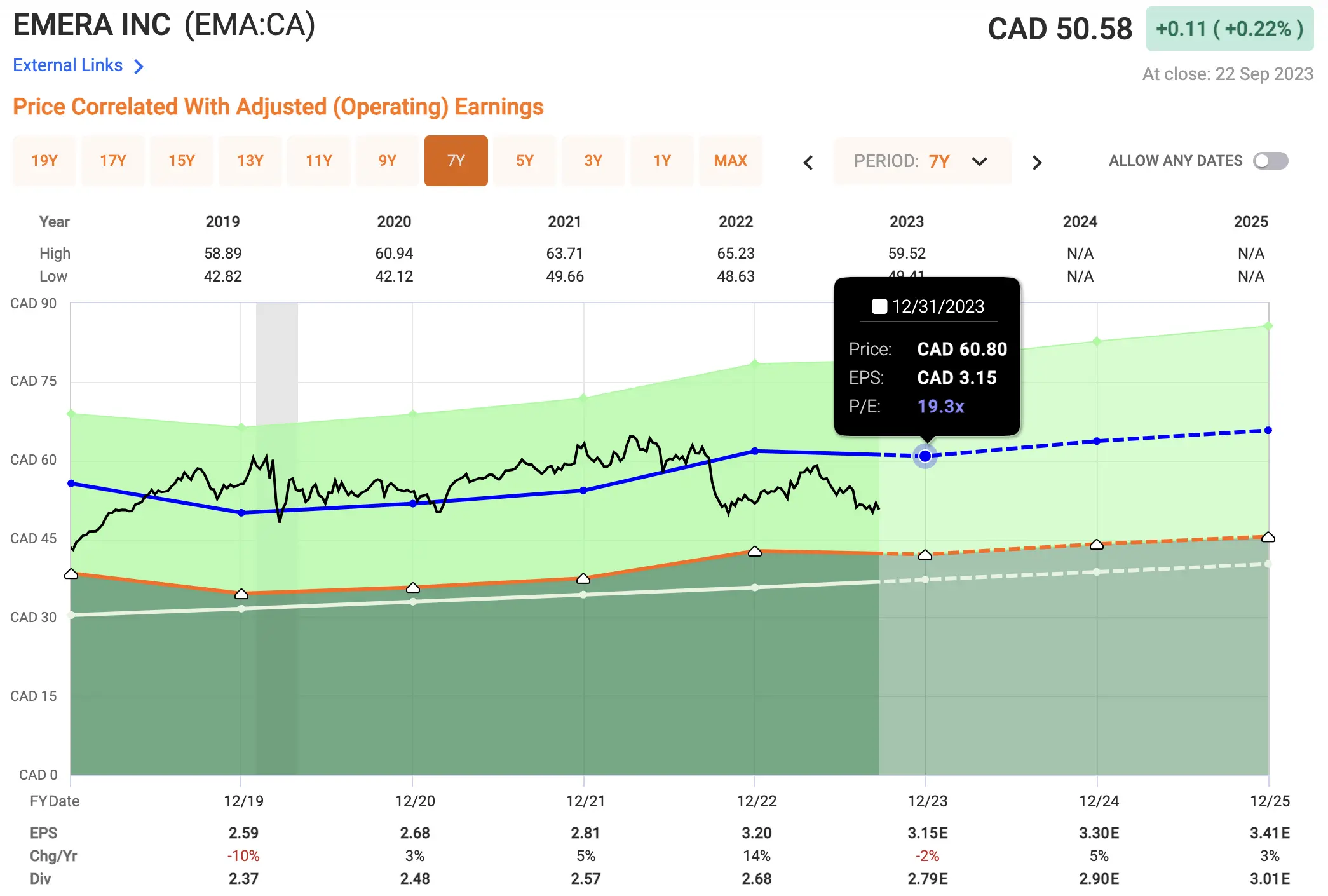

When I purchased shares of Emera, I used both EBITDA and operating cash flow (OCF) as a valuation metric. However, watching videos on valuation as well as looking at Emera’s own shareholder presentations, they use earnings instead. Here is a graph correlating the Emera stock price with earnings. With a normal P/E of 19.3, we get a fair value estimate of $61 in 2023. But if we use a standard P/E of 15, we get a fair value estimate of $47.

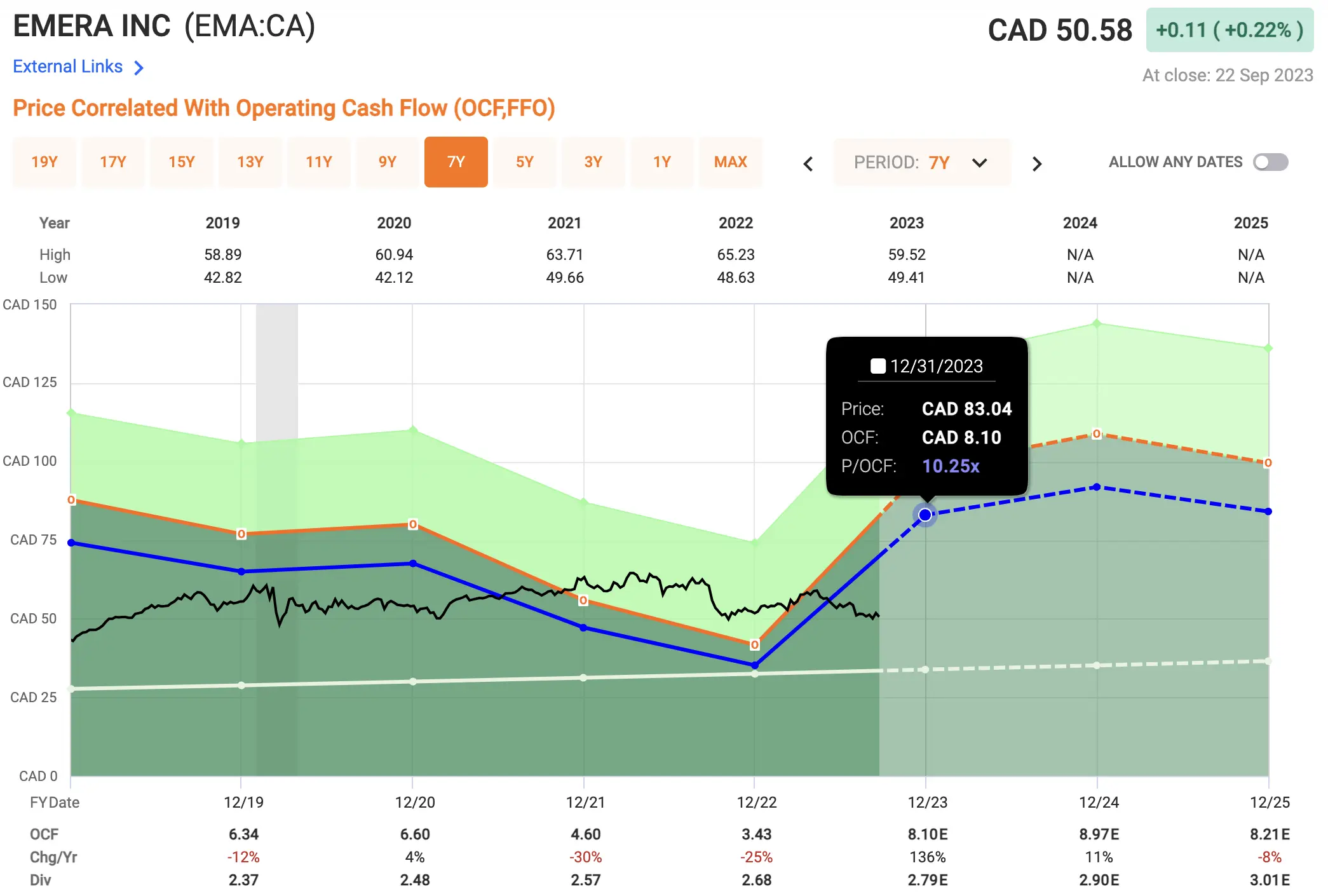

The dividend is safe. It is well covered (white line) by the operating cash flow (dark green area). In addition, Emera’s operating cash flow is expected to increase by 10% compared to 2022 [2]. The dividend is expected to grow by 4-5% until 2025.

There has been a lot of insider buying by independent directors. The most recent is an independent director purchasing $1MM worth of shares on the open market at $50.53/share in August 2023 [3].

What about the impact of interest rates? After all, we know that utility companies are capital intensive. According to the 2022 annual report, Emera spent $2.646B. Their plan for 2023-2025 is to spend $8B-$9B, which is $2.66B-$3B/year. While I’m not keen on the continued spending levels when interest rates are high, I see that most of their debt is long-term debt versus short-term debt. Most of the capital expenditures (75%) will be focused in Florida, a state where there generally is no concern with increase in regulated rates.

To close off, here’s a video of Chuck Carnevale (aka Mr. Valuation) evaluating US utility companies in 2022.