Recent Purchase: Telus Corp

As I mentioned in a recent post, I started buying securities again. Whenever I start buying securities, my go to stocks are Royal Bank (RY.TO) and Telus Corp (T.TO). I have some concerns about the impact of high interest rates on mortgages and increased provision for credit losses (PCL), so I didn’t put more money into Royal Bank. My first purchase in a long time were shares of Telus Corp at $22.85. I have existing shares of Telus at a higher price, so this purchase reduced my average cost basis.

In their Q2 2023 report, Telus reported strong revenue growth in their core business. But their earnings were impacted by interest, depreciation, amortization, and restructuring costs [1]. In addition, the company is planning to lay off 6,000 employees. And finally as a result of Telus International’s (TIXT.TO) revised 2023 guidance, Telus guided lower on revenue and EBITDA growth [2]. So why did I purchase shares to Telus?

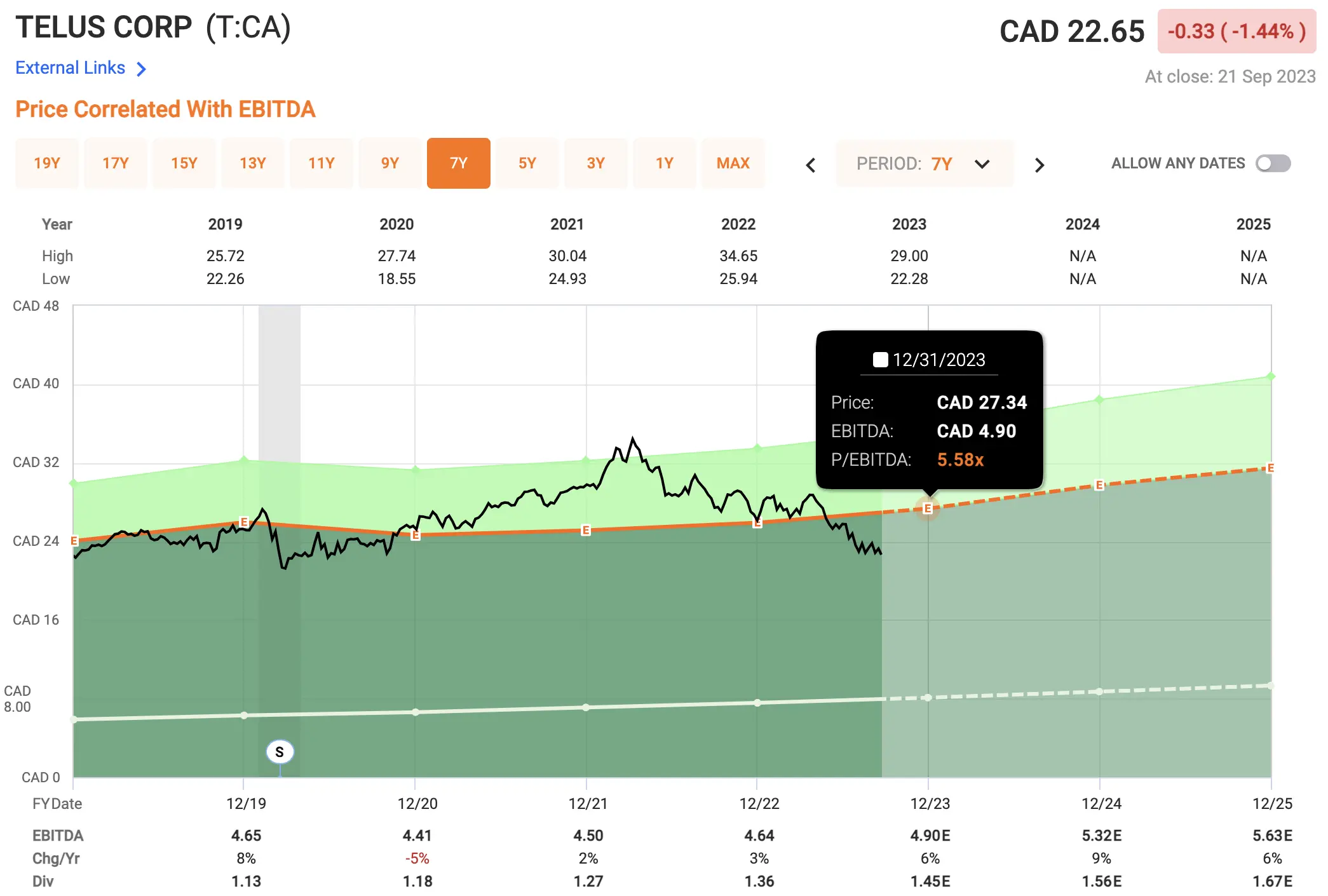

- The stock price looked undervalued when using EBITDA as a valuation metric.

- The company is still expected to grow at a decent pace.

- There is insider buying at higher prices.

- 9 out of 11 analysts say that Telus is a buy. The lowest price target is approximately $27.

- The dividend yield is 6.4%, which is higher than what I can get from a savings account.

Although earnings were impacted by interest, depreciation, and amortization, I excluded the impact of those in order to get a better understanding of the company’s earnings and growth. Here is a graph correlating the Telus stock price with EBITDA. With a P/EBITDA of 5.58, we get a fair value estimate of $27 in 2023.

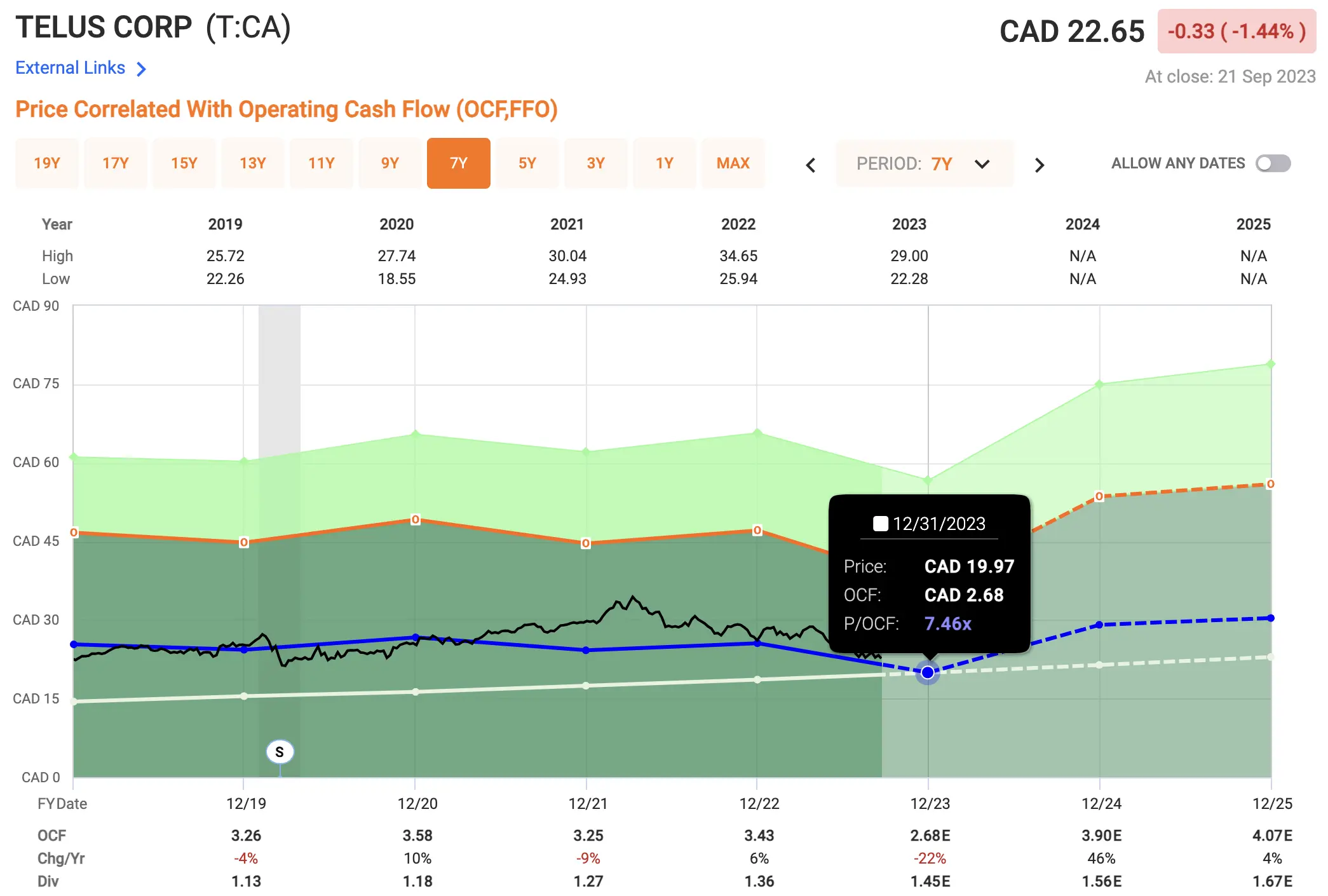

I consider telecom companies similar to utility companies in that they have to build and install assets that generate income. The one difference is that telecom companies are not as impacted by the price of commodities. They’re both affected by interest, depreciation, and amortization. The way I value utility companies today is to use operating cash flow (OCF) and maybe I should consider using EBITDA instead. I’m still learning. Telus is overvalued using operating cash flow as a metric. But the one thing that OCF tells me is that the dividend (white line) is well covered by OCF (dark green area).

What about the impact of higher interest rates in 2023? According to their 2022 annual report, Telus is slowing down its capital expenditures in 2023 ($2.6B) compared to 2022 ($3.472B). Telus accelerated its capital expenditures in 2021 ($3.498B) and 2022 when interest rates were lower. So it seems like they know what they’re doing.

There has been a lot of insider buying by independent directors. Even the CEO is loading up, which is always a good sign because their wealth is tied to the performance of the company. He purchased close to US$4MM worth of shares on the open market at around US$17/share between the beginning of August 2023 and the end of September 2023 [3].

To close off, I mentioned in a previous post that I recently discovered YouTube videos from Dan Kent of Stocktrades. He has a video where he discusses the 3 big Canadian telecom companies and why their dividend is safe even though the payout ratio is above 100%. Check it out below.