Wealthsimple Review

As Canadians, we’re jealous of the perks that US financial companies offer. These perks include zero-commission trades, low-commission options, no foreign-exchange fee credit cards, etc. There is a lack of competitive landscape here in Canada. Questrade has been one of the better low-fee investment brokerages for self-directed investing for a long time. That’s what drew me in as a customer 6 years ago. At Questrade, trading fees for stocks start at $4.95 and include the dreaded ECN fees. As someone who owns numerous dividend-paying stocks in my portfolio, I felt like I was being nickeled and dimed every time I added to my existing positions. The one saving grace for Questrade was zero-commission ETF purchases. The caveats are that selling is not free and buying in odd lots (not multiples of 100) often leads to commissions.

There are 2 Canadian brokerages that I’m aware of today that offer zero-commission trades: National Bank and Wealthsimple. Like EQ Bank, Wealthsimple is a burgeoning Canadian fintech company changing how we invest and bank in Canada. Wealthsimple has been around since 2014. I remember when they started as a robo-advisor. Since those days, they’ve continued to improve their offerings. In recent years they have become very aggressive in their promotional offers to acquire customers. This summer (and to continue into the fall), they were offering 1% cash back on all assets transferred, in addition to transfer fee reimbursement for transfers over $15,000. I remember when Wealthsimple had an iPhone 15 promotion and thought that they could do better. This 1% offer was too enticing to ignore.

What is Wealthsimple?

Wealthsimple is a private Canadian fintech company headquartered in Toronto. It is primarily known as a brokerage company that offers self-directed investing through Wealthsimple Trade and robo-advisor services through Wealthsimple Invest. Wealthsimple is owned by Power Corporation.

What Products does Wealthsimple Offer?

I have observed Wealthsimple evolve over the years. Their product offerings have expanded significantly recently. While I was not interested in Wealthsimple in the past, their products are now compelling. They offer the following:

- Wealthsimple Invest (robo-advisor)

- Wealthsimple Trade (self-directed investing)

- Wealthsimple Cash (savings account)

- Tax filing (acquired SimpleTax)

- Options trading (limited options strategies)

- Crypto trading

- Private credit

- Private equity

- Mortgages (through Pine)

Is Wealthsimple Safe?

Yes, your assets are safe with Wealthsimple. Investment accounts at Wealthsimple are insured by the Canadian Investor Protection Fund (CIPF) as they would be at any other Canadian brokerage. Cash accounts at Wealthsimple are insured by the Canadian Deposit Insurance Corporation (CDIC) as they would be at a Canadian bank. One interesting difference is that your cash account can be spread across multiple banks. While a regular bank protects $100,000 in cash, Wealthsimple can protect $500,000 in cash.

As of the end of March 2024, Wealthsimple manages close to $39B in assets. It is also owned by Power Corporation, a very stable company. I don’t forsee Wealthsimple going away any time soon.

Wealthsimple Tiers

There are 3 tiers at Wealthsimple. Your tier depends on how much you have in assets. Each tier offers varying levels of benefits for each of its product offerings. Here are some of the benefits of each tier.

| Core | Premium | Generation | |

|---|---|---|---|

| Required assets | $1 | $100,000 | $500,000 |

| Trading fee | Free | Free | Free |

| USD account | $10/mo | Free | Free |

| Options pricing | $2 | $0.75 | $0.75 |

| Robo-advisor fee | 0.5% | 0.4% | 0.2%-0.4% |

| Cash interest* | 3.25% | 3.75% | 4.25% |

| Priority support | No | Yes | Yes |

| Airport lounge | No | No | 10/year |

With a direct deposit of $2,000/mo, Core and Premium users can receive an additional 0.5% in interest on their Cash account balance.

Wealthsimple also offers household accounts where the total household assets count toward the required assets for a tier. For example, two adults in a household with $500,000 in assets at Wealthsimple each get 10 airport lounge passes per year, for a total of 20 airport lounge passes per year.

Wealthsimple Offers

Wealthsimple runs multiple offers regularly. They have a referral offer where each party receives $25. But the 1% offer was the one that enticed me to switch to Wealthsimple. Transfer any amount to Wealthsimple within 30 days after you sign up for the offer and receive 1% in cash back divided over 12 months. Users must open a Wealthsimple Cash account as that is where the cash back will be deposited.

For investment accounts, that’s a no-brainer because where else will you get an additional 1% return on your investments? For savings accounts, this is also a no-brainer. Wealthsimple offers some of the highest interest outside of promotional interest rates.

Limitations of Wealthsimple Trade

Wealthsimple Trade is Wealthsimple’s self-directed investment product. It offers a lot of the same capabilities as other brokerages. However, there are limitations that you’ll certainly need to consider. I would argue that Wealthsimple Trade is excellent for most Canadian retail investors. But as you acquire more money and gain more expertise, you’ll realize the limitations. These include:

- No research capability

- Lack of charting capability

- Cannot hold dual-listed stocks (cannot execute Norbert’s Gambit)

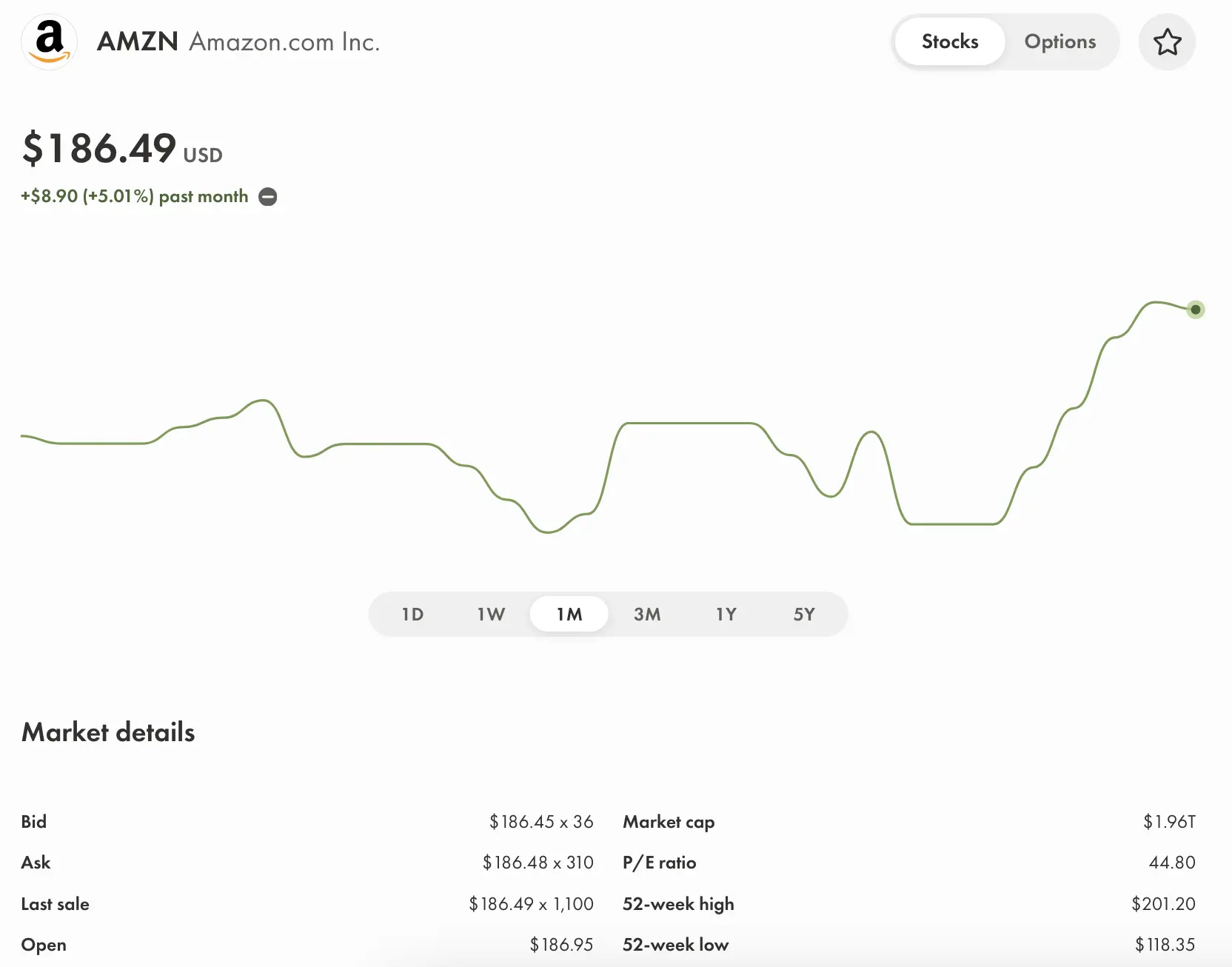

The stock page on Wealthsimple for a specific stock ticker is similar to what you’d see on Yahoo! Finance or Google Finance. You get a simple price chart, some details about the stock price, and a news feed. There are no reports, no analyst ratings, nothing. Charting is limited to the stock price over a period of time. You cannot add moving averages, histograms, etc. However, Wealthsimple is sufficient for the vast majority of Canadian retail investors since they don’t care or use these features.

The feature that’s sorely missing is the ability to hold dual-listed stocks (for Norbert’s Gambit). At other brokerages, you can buy dual-listed stocks on either the US or Canadian exchanges. However, at Wealthsimple you may only purchase shares on the stock’s primary exchange. For example, if you want to buy shares of Royal Bank of Canada, you have to purchase RY.TO on the TSX. You cannot buy RY on the NYSE.

This limitation has two implications that you should be aware of. The first is that you cannot perform Norbert’s Gambit as there is no way to journal shares on Wealthsimple. To exchange CAD and USD, you either pay Wealthsimple’s 2.5% currency exchange fee or exchange off-platform and transfer USD into your investment account. Users report using EQ Bank’s USD account to exchange currencies and transfer USD from EQ Bank to Wealthsimple. The caveat to holding USD in your investment account is that you must have a USD account at Wealthsimple. A USD account at Wealthsimple usually costs $10/mo, but it’s free for Premium and Generation users. Otherwise, Wealthsimple will automatically convert any USD cash you hold to CAD, immediately incurring the 2.5% currency exchange fee.

The second implication is that if you transfer dual-listed stocks into Wealthsimple, Wealthsimple may automatically journal shares. For example, assume that you held RY in your Questrade account because you wanted your dividends paid in USD. Once you transfer the shares to Wealthsimple, they will be journaled to RY.TO.

Transferring Accounts

I opened an account at Wealthsimple in the past but never funded it. As a US citizen and Canadian resident, I was unsure if their robo-advisor services would take my US citizenship into account when choosing funds. I didn’t want to take the chance. I also use SimpleTax. So when SimpleTax was acquired by Wealthsimple, my account was transferred.

Now that Wealthsimple has a self-directed investing platform, I was ready to jump in. Opening an RRSP and non-registered account at Wealthsimple was easy, but only for Canadian citizens. While I disclosed that I was a US citizen using their new account wizard, the list of documents that I had to sign electronically was incorrect. They had me sign a W-8BEN, which is correct for a Canadian citizen. However, as a US citizen, I needed to fill out a W9. I contacted support and they sent me a Docusign form to sign. Once that was completed, it was sent to their backend team. Once the documents were processed, I continued from where I left off. The account opening process took 2 business days.

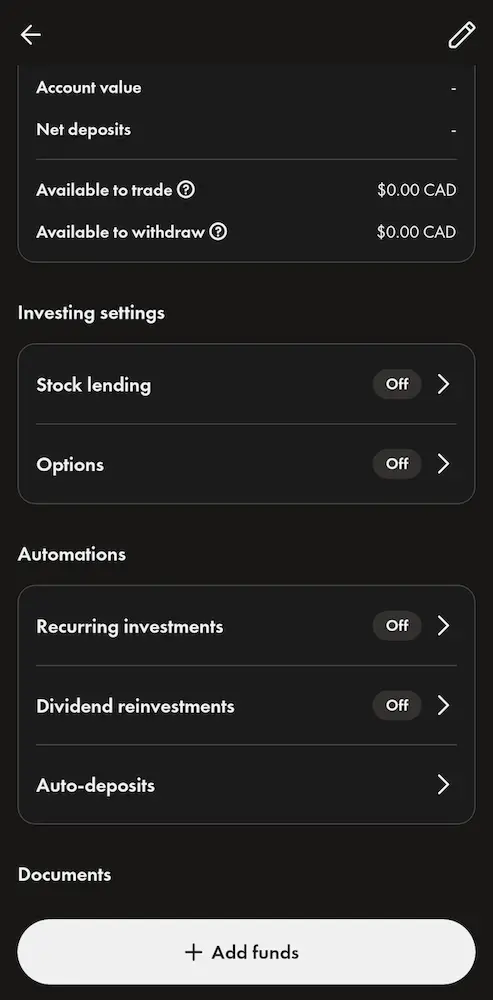

One of the sneaky documents that they ask you to sign is the stock lending agreement. Some people like the idea of getting additional money if their shares are loaned out. They don’t lose their dividends when shares are loaned out. However, I worry that the dividends will not receive beneficial tax treatment when I fill out my US tax forms. I ended up not signing that form, which didn’t affect the account opening process. Most people only discover that their shares are loaned out much later. You can always enable or disable stock lending in the app later.

I was planning to transfer 2 accounts from Questrade, so I wanted to ensure that I didn’t miss a step or perform steps in the wrong order. I created the following checklist:

- Sign up with a referral code from a Generation user.

- Sign up for the 1% offer.

- Open a non-registered account.

- Open an RRSP account.

- Open a USD account.

- Ensure that the USD account is enabled.

- Turn off stock lending.

- Fill out beneficiary forms.

- Transfer accounts.

The first step didn’t matter because I already had a Wealthsimple account and could not apply a referral code. If you’ve never had a Wealthsimple account, determine which tier you will become and get a referral code from someone at the same tier.

Next, it’s important to sign up for the 1% offer. This step was not on my original list and I forgot to do it until after I initiated the account transfer. That messed up the offer and I was missing a portion of the expected promotional bonus. Fortunately, customer support was able to change the time of the 1% offer sign-up.

I first opened a non-registered account where I faced issues filling out the appropriate US tax forms. Once that was complete, I opened an RRSP account. This time I didn’t have problems with US tax forms. As part of the account opening process, I refused to accept the stock lending agreement. This ensured that I wasn’t signed up for stock lending and didn’t have to disable it in the app later.

Next, I opened a USD account. I wasn’t sure how this worked, which is why I have two steps for USD accounts. It should be one step. Once you sign up for a USD account, it becomes available for every self-directed investment account. The USD account allows you to hold USD. If you sell shares of US stocks, the USD cash won’t be converted to CAD automatically. It is free for 30 days. I was expecting that I would transfer enough assets to Wealthsimple before the free trial expired to reach the Premium tier, where USD accounts are free.

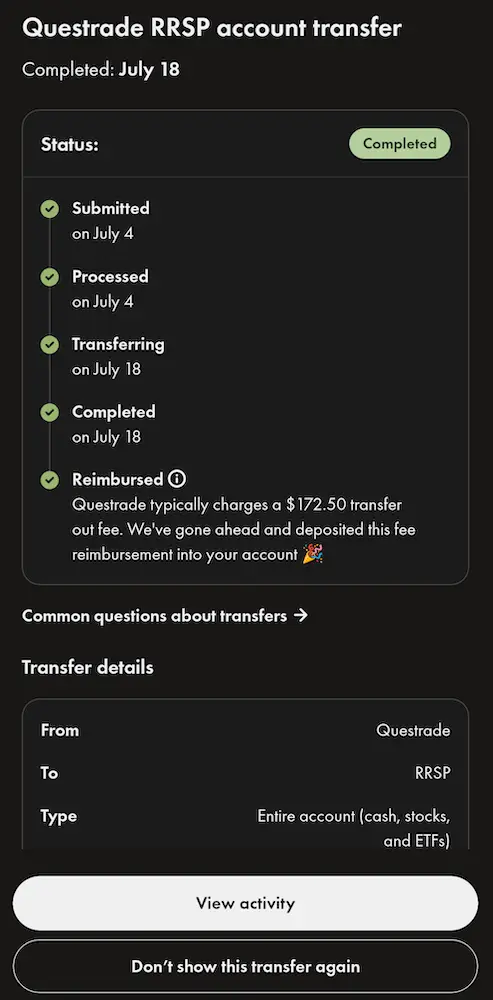

For my RRSP account, I initiated a full account transfer. I wanted all of my shares and cash transferred to Wealthsimple. Questrade charges a fee of $150 plus tax to transfer an account. I ensured that I had enough cash in my account to cover the transfer fee. It took 2 weeks to complete the transfer. My account at Questrade was automatically closed and Wealthsimple automatically reimbursed the fee.

Next, I wanted to initiate a partial account transfer of my non-registered account. My non-registered account contained US and Canadian stocks, USD, and CAD. I didn’t want my entire account closed by Questrade but instead wanted all of my stocks and USD transferred and most of my CAD transferred. Wealthsimple doesn’t support self-service partial account transfers, so I had to call customer support. They asked me to upload the most recent Questrade statement so that they can confirm which assets to transfer. Later, the customer support agent sent me the account transfer doc to review and approve. There were mistakes in the account transfer form, so we corresponded and the customer support agent corrected the document.

I didn’t read the terms of the 1% offer properly. On the initial call with the customer support agent, they verified that I was signed up for the 1% offer. I didn’t ask for it, but the customer support agent was proactive. They suggested that I sign up for the Cash account because that’s where the promotion bonus will be deposited.

The non-registered account took 3 weeks to complete the transfer. After the second week, I saw that everything but my US ETFs were transferred. I contacted customer support by email. They responded quickly and said that Questrade transferred the US ETFs via DTC, which US brokerages support but Wealthsimple does not. Wealthsimple requested that the US ETFs be transferred via CDS. A week later, the US ETFs were transferred and the transfer fee was automatically reimbursed.

Customer Service

The account opening and transfer processes were not seamless because I am not a Canadian citizen performing a full account transfer. However, I was impressed with their automated account transfer process. I liked that they automatically reimbursed the transfer fee without asking. When I transferred my account from TD Waterhouse to Questrade, they asked for proof that TD charged a transfer fee. Unfortunately, transferring an account out of TD meant that TD closed the account and I no longer had access to statements. Questrade was unwilling to budge.

I have read people on Reddit and RedFlagDeals complain about Wealthsimple customer support. However, I only have good things to say about their customer support. Both non-premium and premium support were able to provide answers to my questions quickly with little to no back and forth. I have absolutely no complaints.

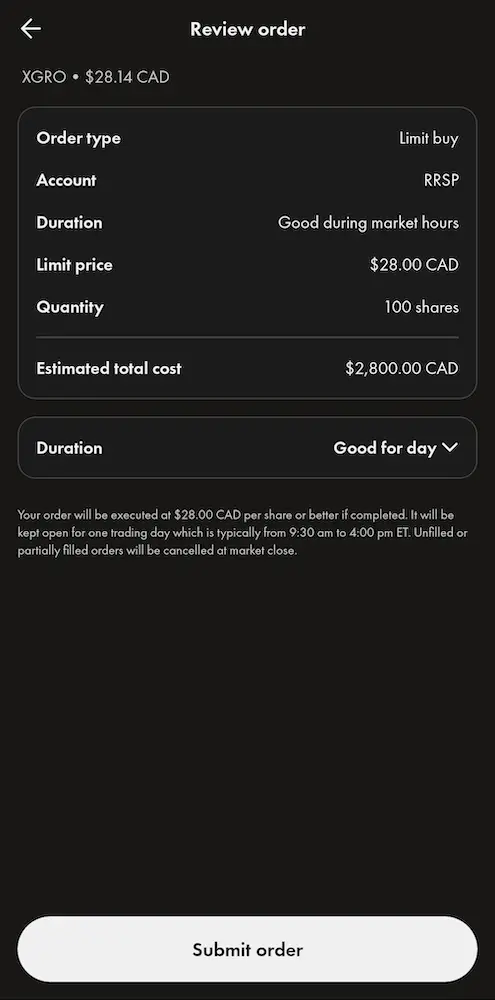

Trading on Wealthsimple

Trading on Wealthsimple was easy.

- Select the account.

- Click the

Tradebutton. - Enter the stock symbol.

- Click the

Buy(orSell) button. - Enter the number of shares and the price.

- Select limit order unless you want a market order. You need additional funds for market orders to account for price fluctuation.

- Click the

Reviewbutton. - Click the

Submit Orderbutton.

Receiving the Promotional Bonus

I received the promised promotional bonus in my Cash account for two months. I have also received the 4.5% (now 4.25%) interest on cash in my Cash account. I recently signed up for the Wealthsimple Visa Infinite credit card, which pays a 2% cash back. I’ll write a post about that soon. It feels nice to receive interest from your broker or bank. Now if only they would pay interest on the cash balance in my investment account…

Using Wealthsimple Outside of Canada

Users reported that they were contacted by Wealthsimple to confirm that they’re still residents of Canada. Users who have left Canada were asked to move their account to another brokerage. Wealthsimple does not support non-residents. Wealthsimple discovered these cases by tracking IP addresses. So if you’re outside of Canada temporarily, avoid using Wealthsimple. If you’re outside Canada for an extended period, a VPN might work, but you’re violating the terms and conditions.

Conclusion

Overall, I’m enjoying Wealthsimple. It doesn’t offer everything I want from an investment brokerage, but I can get what I need from other platforms. However, I believe Wealthsimple provides the level of service that most Canadian retail investors want from a trading platform.