Wealthsimple Visa Infinite Review

I heard about the Wealthsimple Visa Infinite credit card earlier this year. It was offered as a beta product for a select group of users. The credit card offered 0.5% in cash back plus an additional 0.5% if you pay off the balance within 48 hours of receiving the statement. That was a terrible offer. Many free credit cards pay 1% in cash back without any special requirements.

Now that I’m a Wealthsimple customer, I recently received an offer to join the beta program. The perks are much better than the prior offer. The email states:

We’re planning the launch of our first-ever credit card, and want you to help make it great.

As some of the first clients with our credit card, you’ll have the exclusive opportunity to help us improve the product’s rewards, benefits, and overall experience.

The Wealthsimple Visa Infinite offers:

- Up to 2% cash back on all purchases, with no bonus categories to track

- $0 monthly fee for Premium and Generation clients ($10/month otherwise)

- Cash back directly into your Cash account to start earning up to 4.5% interest right away

As a Generation client, this card would be free for me. The 2% cash back is decent. The question I had to ask myself was whether I needed this card. Does it replace existing cards?

I have the following credit cards:

- PC Financial World Elite Mastercard

- Rogers Platinum Mastercard

- Triangle World Elite Mastercard

- TD Cash Back Visa Infinite

- Scotiabank Passport Visa Infinite

Of these cards, the first two are my own personal credit cards. The other three are joint credit cards. After getting the Scotiabank Passport Visa Infinite credit card and the EQ Bank Card, I no longer use my Rogers Platinum Mastercard. I wrote about it in a previous post. While I could get the Rogers Red Mastercard instead, I think I will eventually get rid of this card.

I use the Triangle World Elite Mastercard for purchases at Canadian Tire. With weekly Canadian Tire offers, I can stack numerous offers that pay an incredible amount of cash back (in Canadian Tire money). I received offers such as “spend $4.99 and receive $5.00 in CT money”. This past week, I purchased a home maintenance product. By swapping offers in the app and paying with my Triangle credit card, I received 10% cash back. I can pay utility bills using the credit card. As an owner of the World Elite Mastercard, I receive an annual Canadian Tire roadside assistance membership for free as well as coupons for auto service. This one is a keeper.

The TD Cash Back Visa Infinite credit card is my primary credit card for joint expenses. While there is an annual fee, the fee is reimbursed every year. It earns 3% cash back on gas and groceries and 1% on everything else. TD roadside assistance is included as well.

Earlier this year, I signed up for the Scotiabank Passport Visa Infinite credit card. I use this credit card for personal and work travel. The biggest benefit of the card is that it doesn’t charge foreign exchange fees. It earns 1% cash back in Scene+ points, which can be redeemed towards purchases in the travel category. It also comes with 6 airport lounge passes annually. While there is an annual fee, the fee is reimbursed every year.

That leaves the PC Financial World Elite Mastercard. It earns 3% cash back in PC Optimum points at certain grocery stores and 1% everywhere else. It can be easily replaced by the TD Cash Back Visa Infinite credit card and the cash back doesn’t have to be used at grocery stores. I use this card for my personal expenses, earning 1%. Since the Wealthsimple Visa Infinite credit card earns 2%, it makes sense to switch over my personal expenses. I won’t get rid of the PC Financial World Elite Mastercard since it is my oldest credit card.

Eligibility

To be eligible for the Wealthsimple Visa Infinite credit card, you must:

- Be a resident of Canada (excluding Quebec) and must be the age of majority.

- Have a personal income of $60,000 or a household income of $100,000.

- Have a Wealthsimple Cash account.

Benefits

The Wealthsimple Visa Infinite credit card offers the following perks:

- 2% cash back on the first $3,000 spent per month, 1% after.

- Mobile device insurance (accidental damage, loss, theft protection for up to 2 years).

- Purchase protection (damage, loss, theft protection for 90 days).

- Extended warranty (doubles manufacturer warranty).

Inconveniences

As with many other credit cards, the Wealthsimple Visa Infinite credit card charges a 2.5% fee on foreign transactions. If there were no foreign transaction fees, like with the Wealthsimple Cash pre-paid card, it would make this an excellent credit card.

Users may only pay off the credit card using a Wealthsimple Cash account. They cannot use bill pay from another financial institution. Transferring money into Wealthsimple from another financial institution can take up to 5 business days, though a large amount is available immediately. Alternatively, you can e-transfer to your Wealthsimple account and funds wil be available in up to 30 minutes.

Cost

The credit card costs $10/mo. However, there are a couple of ways to get the credit card for free. Premium and Generation clients automatically get the fee waived. Core clients can get the fee waived by setting up a direct deposit of at least $2,000/mo.

Sign-Up Process

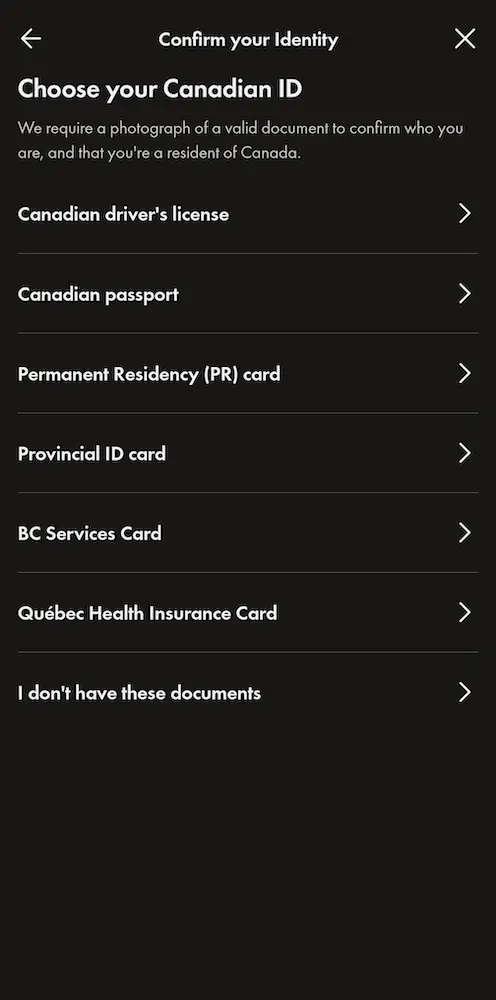

The sign-up process was simple. You add the credit card account the same way you would add a new Wealthsimple account. The first step involves providing your annual income. Wealthsimple starts with a soft credit check to confirm your eligibility. Once you choose to continue the sign-up process, the app asks for a picture of a government ID and a selfie. Wealthsimple will then perform a hard credit check. Once you’re approved, you’ll be informed of the credit limit.

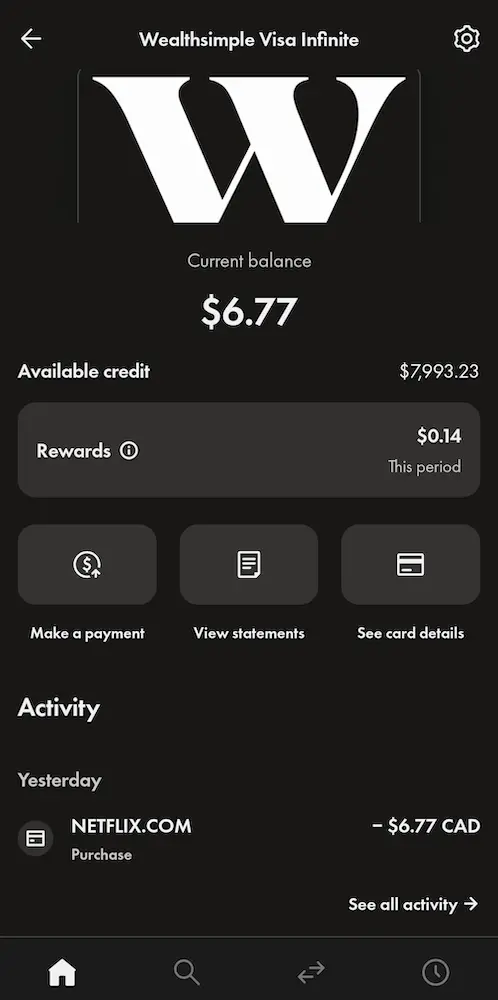

Within the app, you can view the credit card details. The app provides the 16-digit credit card number, the expiration date, and the security code. I used this information to add the credit card to my Google Wallet and change my default payment method instrument for various services. A physical credit card will be mailed in 2-3 weeks. Once the physical credit card arrives in the mail, it can be activated within the app.

Conclusion

Overall, I’m happy with the new Wealthsimple Visa Infinite credit card. While it doesn’t offer many perks, the cash back is better than my PC Financial World Elite Mastercard. It certainly has a place in my wallet.